2. Calculate Real GDP

In a second step, we can now calculate real GDP. Unlike nominal GDP, real GDP shows the monetary value of all finished goods and services within an economy valued at constant prices. That means, we choose a base year and use the prices of that year to calculate the values of all goods and services for all the other years as well. This allows us to eliminate the effects of inflation.

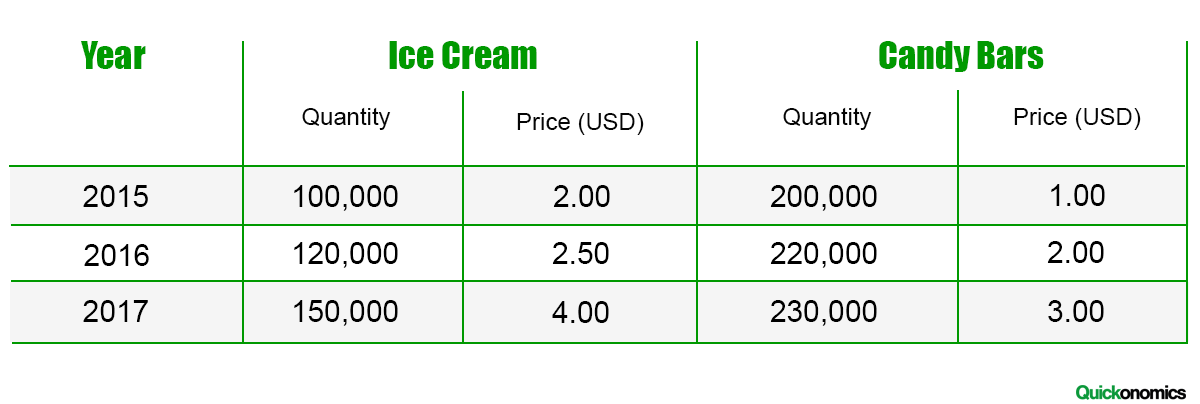

In our example, we’ll pick 2015 as our base year. Thus, the reference prices of ice cream and candy bars are USD 2.00 and USD 1.00, respectively. Starting from there, we can now calculate real GDP for all three years. In 2015 real GDP amounts to USD 400,000 (100,000*2 + 200,000*1). Note that in the base year, real and nominal GDP are always the same because we use the same prices when calculating them. Meanwhile, for 2016 real GDP is USD 460’000 (120,000*2 + 220,000*1) and for 2017 it amounts to USD 530,000 (150,000*2 + 230,000*1). If you compare these numbers to the numbers we calculated above, you can already see that real GDP doesn’t grow quite as much as nominal GDP.

3. Calculate the GDP Deflator

Now that we know both nominal and real GDP, we can compute the actual GDP deflator. To do this, we divide nominal GDP by real GDP and multiply the result with 100. This gives us the change in nominal GDP (from the base year) that cannot be attributed to changes in real GDP. Check out the formula below:

Going back to our example, we can quickly see that the GDP deflator for 2015 is 100 ([400,000/400,000]*100). The GDP deflator for the base year will always be 100 because nominal and real GDP have to be equal. However, things become more interesting when we look at the following years. For the year 2016, the GDP deflator is7 160.9 ([740,000/460,000]*100). That means, from 2015 to 2016, the price level has increased by 60.9% (160.9 – 100). Similarly, the GDP deflator for 2017 is 243.4, which reflects a price level increase of 143.4% compared to the base year.

In a Nutshell

The GDP deflator is a measure of the price level of all domestically produced final goods and services in an economy. It is sometimes also referred to as the GDP Price Deflator or the Implicit Price Deflator. It can be calculated as the ratio of nominal GDP to real GDP times 100 ([nominal GDP/real GDP]*100). This formula shows changes in nominal GDP that cannot be attributed to changes in real GDP. Hence, the GDP deflator is often used by economists to measure inflation, together with the Consumer Price Index (CPI).