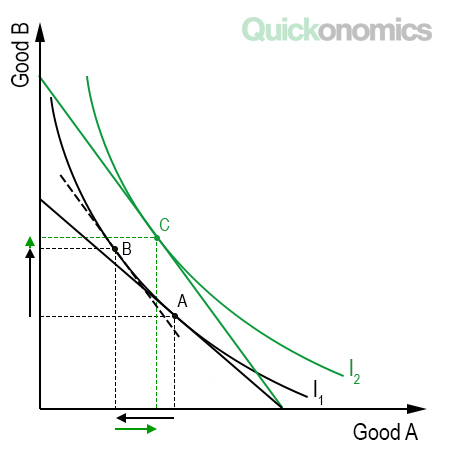

Updated Jan 3, 2023 The impact of a change in the price of a good or service on consumption can be broken down into two separate effects: the income effect and the substitution effect. The income effect describes the change in consumption caused by a change in purchasing power. Meanwhile, the substitution effect describes the change in consumption that happens because money is shifted between products. Because these two effects don’t always work in the same direction, the outcome of a price change can be ambiguous. We’ll learn exactly how that works in the paragraphs below. The income effect describes how a change in the price of a good or service affects consumption by altering the purchasing power of people’s income. That means when the price of a product falls, people become relatively richer because they can buy more of the same or other goods with the same amount of money. Thus, the change in price affects the purchasing power of their income, similar to a change in the income itself (hence the name). To illustrate this, meet John. Assume that John has USD 100 in his pocket and loves food. He spends all of his money to buy 8 large pepperoni pizzas at USD 10 apiece and 10 ice cream sandwiches at USD 2 apiece (i.e., 8 x 10 + 10 x 2 = 100). Now, let’s say the price of pizza falls from USD 10 to USD 8. At that price, John can buy 9 pizzas and still have enough money to get 14 ice cream sandwiches (i.e., 9 x 8 + 14 x 2 = 100). That means he gets 1 additional pizza and 4 extra ice cream sandwiches for the same money. The substitution effect describes how a change in the price of a good affects consumption by reallocating resources between products. That means when the price of a product falls, other products become relatively more expensive, which can cause people to substitute some of the more expensive goods and services for the now cheaper product (hence the name). The magnitude of this effect depends on the marginal rate of substitution between the products. To give an example, let’s revisit our friend John. To keep things simple, we’ll assume that the situation is the same as before (see above). Only this time, John considers the trade-off between pizza and ice cream (i.e., the exchange rate between the two products). Because the price of pizza has fallen, he can now get more pizza for every ice cream sandwich he gives up. That means the ice cream has become relatively more expensive compared to pizza. Therefore, John decides to shift a portion of his budget and buy 11 pizzas and only 6 ice cream sandwiches at the new price (i.e., 11 x 8 + 6 x 2). That means he sacrifices some of his ice cream consumption to buy even more pizza. We can visualize the income and substitution effects using indifference curves. In that context, the income effect describes the change in consumption that results when a price change moves the consumer to a higher or lower indifference curve. Meanwhile, the substitution effect describes the change in consumption that occurs when a price change moves the consumer along a given indifference curve to a point with a new marginal rate of substitution. This is illustrated in the graph below. It shows the effect of a drop in the price of Good B. The two diagonal lines represent the budget constraints (black=old budget constraint, green= new budget constraint). The substitution effect moves the initial optimum (A) on the initial indifference curve (I1) to point B, as indicated by the black arrows. Meanwhile, the income effect shifts the optimum to a new indifference curve (I2) at the intersection of the new budget constraint (C), as indicated by the green arrows. Note that the income effect tends to make consumers buy more of the good that has become cheaper and the other good at the same time. By contrast, the substitution effect tends to make consumers buy more of the good that has become cheaper instead of the other. Therefore, the end result of a price change can be ambiguous. After the price reduction, consumers certainly buy more of good B, because both the income and the substitution effects work in the same direction. However, the impact on the consumption of good A can go either way, because the income and substitution effects work in opposite directions. In that case, the outcome depends on which effect is stronger. The impact of a change in the price of a good or service on consumption can be broken down into two separate effects: the income effect and the substitution effect. The income effect describes how a change in the price of a good affects consumption by altering the purchasing power of people’s income. By contrast, the substitution effect describes how a change in the price of a good affects consumption by reallocating resources between products. Because these two effects don’t always work in the same direction, the outcome of a price change can be ambiguous.Income Effect

Substitution Effect

Visual Representation of Income and Substitution Effect

Summary

Sources

(2nd ed., revised ed.) Andover: Cengage Learning. 451-452.

Microeconomics