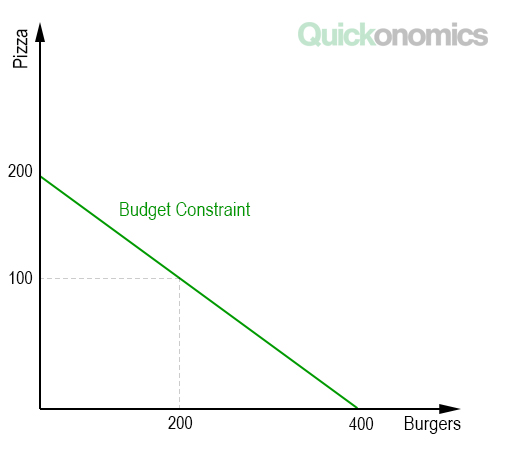

Updated Jan 17, 2023 A budget constraint is defined as the limit on the consumption bundles that a consumer can afford. That means it describes the maximum number of all the possible combinations of goods and services a consumer can afford, given their current income. Thus, it is an economic tool used to keep track of spending and ensure that expenditures do not exceed available funds. Let’s say you have a friend called Tommy, who likes to eat pizza and hamburgers. Tommy works part-time as an accountant and has a monthly income of USD 2,000. For the sake of this example, we’ll assume that Tommy spends all of his income on pizza and burgers. A large pepperoni pizza costs USD 10.00, and a burger costs USD 5.00. Thus, if Tommy were to spend all of his money on pizza, he could get 200 pizzas and no burgers. By contrast, if he spends his entire income on burgers, he can buy 400 burgers and no pizzas. Similarly, he could purchase any combination of pizza and hamburgers that lies within his budget. For example, he can mix it up and get 100 pizzas (USD 1,000) and 200 burgers (USD 1,000), 50 pizzas (USD 500) and 300 burgers (USD 1,500), and so on. Now, if we plot these combinations as well as all other possible combinations in a graph with burgers on thy horizontal axis (i.e., x-axis) and pizza on the vertical axis (i.e., y-axis) we can connect them through a single line (see below). This downward sloping line represents Tommy’s budget constraint. In economics, budget constraints play a vital role when it comes to purchasing decisions and resource allocation. They set the boundaries within which consumers can purchase goods and services to maximize their utility. They beautifully illustrate the concept of opportunity cost, because consumers cannot get everything they want. If they manage to increase their income, their budgetary constraints shift to the right, but they will still face constraints, no matter how high their new budget is. Therefore, consumers and policymakers in all economies around the world have to consider their budgets, make trade-offs and try to get those combinations of goods and services that allow us to maximize our happiness (i.e. utility) within our budget constraints.Definition of Budget Constraint

Example

Why Budget Constraints Matter

Microeconomics