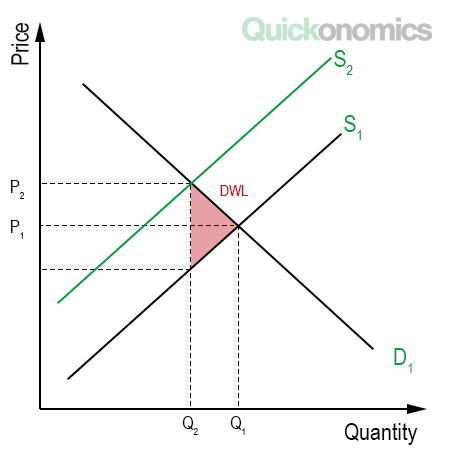

Updated Jan 5, 2023 Deadweight loss is defined as the fall in total surplus that results from a market distortion. That means it describes a cost to society that is created when supply and demand are not in equilibrium because of external interference in the market. In most cases, these market distortions are caused by taxes, price floors, or price ceilings. Let’s look at the market for ice cream. Without external interference, this market reaches its equilibrium at a price of P1 and a quantity of Q1. Now assume the government introduces an ice cream tax to fight obesity. The tax is levied on the sellers. That means, the sellers now have to pay an additional tax on every ice cream cone they sell. As a consequence, they demand a higher price to cover their costs and the supply curve shifts to the left. This government interference results in a higher price P2 and lower quantity Q2. Now, even though the distribution of the tax burden on buyers and sellers (i.e., tax incidence)may vary, we know that both sides are worse off after the tax than before. The only party that is better off (at least in the short run) is the government because it receives additional tax revenue. Meanwhile, the magnitude of the deadweight loss can be illustrated in the supply and demand diagram below. The red triangle between the supply and demand curves represents the welfare loss that is caused by the tax. Deadweight Losses play an important role for policy-makers when it comes to evaluating various options of government regulations and interventions. Whenever the government introduces new taxes or price floors, there is a welfare loss that comes along with it. Hence, in those cases, it is of critical importance that the policy-makers are aware of these consequences. This allows them to weigh the benefits of their actions against the social costs they cause and take actions that are in the best interest of society.Definition of Deadweight Loss

Example

Why Deadweight Loss Matters

Economics