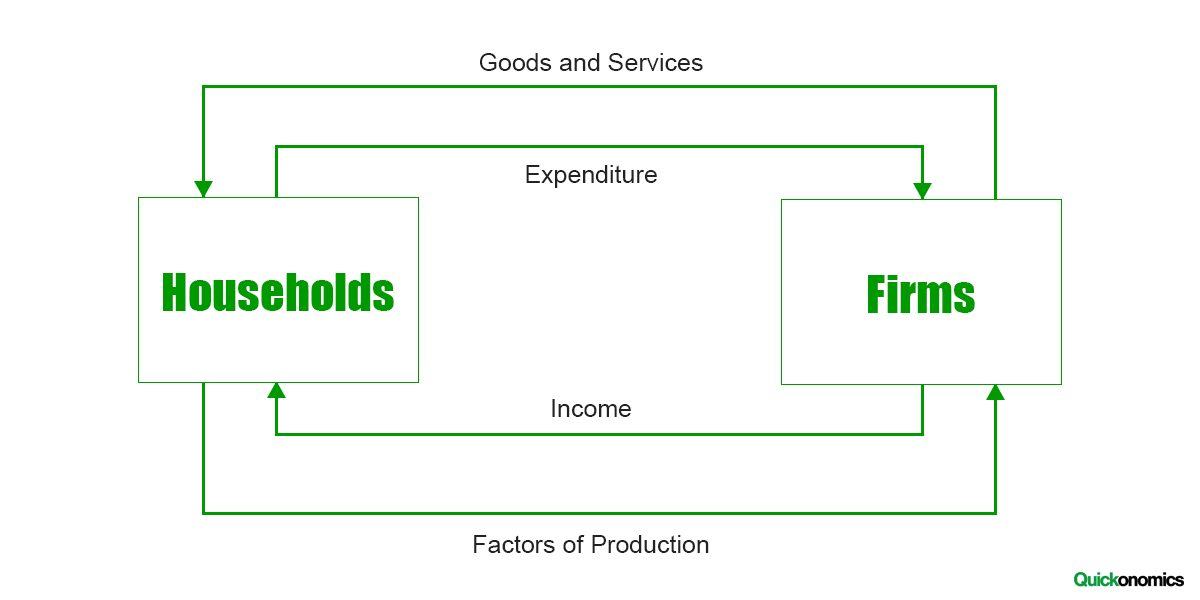

Updated Jun 26, 2020 The Basic Circular Flow of Income Model is one of the most fundamental models in economics. It is also often referred to as the Two Sector Model, because it analyzes the relationship between two economic sectors; households and firms. More specifically, the model illustrates basic exchange processes between the two sectors, namely the flow of money and the flow of goods and services. In the basic circular flow model these flows always correspond in value. To understand why, we have to take a look at the model in more detail. The Basic Circular Flow of Income Model builds on three major assumptions. (1) there are only two sectors, (2) there is no saving, and (3) there is no inventory. Each of those assumptions is explained in more detail below: Based on the assumptions introduced above we can now describe the basic circular flow of income. As mentioned before, the only two sectors included in the model are households and firms. The households provide factors of production (i.e. labor, land, and capital) for the firms to use in their production process. In return, they are compensated with income (i.e. wages, rent or dividends). Meanwhile, the firms use the resources to produce a variety of goods and services. Finally, the households use their income to buy goods and services, thereby transferring all their income back to the firms. If we illustrate these interactions, we can see that both money and goods and services move from one sector to the other in a circular motion. However, the flow of money and the flow of goods and services move in opposite directions (see illustration below). The limitations of the Basic Circular Flow of Income are closely related to its assumptions. First of all, the model does not account for any leakages. In reality however, leakages are fairly common. For example: households may not spend all their money on consumption, or firms may not produce the exact amount consumers will buy. Both of these situations will result in leakages from the circular flow. Secondly, the model is limited to only two sectors. Therefore it is unable to describe a number of critical economic processes, such as saving, government spending, and foreign trade. Fortunately, there are a number of more sophisticated circular flow of income models that do take those sectors into account. The Basic Circular Flow of Income is one of the most fundamental models in economics. It analyzes the relationship between two economic sectors; households and firms. According to the model, the households provide the firms with resources (i.e. labor, land, capital) in exchange for income (i.e. wages, rent, dividends). Meanwhile, the firms use the resources to produce goods and services that they ultimately sell back to the households. Hence, in the Basic Circular Flow of Income Model the flows of money and goods and services always correspond in value but move in opposite directions.Assumptions

Basic Circular Flow of Income

Limitations

In a Nutshell

Basic Principles